Sep ira contribution calculator

About Us Whether youre protecting your loved ones or growing your assets youre highly invested in your financial future. Do not use this calculator if the business employs.

Simplified Employee Pension Sep Ira Contribution Limits And Rules

Divide Line 6 by 200 7.

. So a W2 of 25000. Web For a self-employed individual contributions are limited to 25 of your net earnings from self-employment not including contributions for yourself up to 61000. Self-Employed As a self-employed person you may contribute up to 25 of your earnings to a SEP retirement account.

And so are we. Web The following are some general guidelines for understanding the SIMPLE IRA contribution calculator results. Use the interactive calculator to calculate your maximum annual retirement contribution based on your income.

Web Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA. Web SEP-IRA Plan Maximum Contribution Calculator. Our product is designed to work best for.

Web SEP IRA Contribution Limits The 2022 SEP IRA contribution limit is 61000 and the 2021 SEP IRA contribution limit is 58000. Web Ruby Money is built for independent professionals looking to put their business finances on cruise control while maximizing their wealth. S corporation C corporation or an LLC taxed as a.

Web Calculator How much can I contribute into a SEP IRA. Enter 2 in the Compute maximum allowable contribution field to calculate the maximum allowable SEP deduction. Web SEP-IRA Calculator Results.

Net Business Profits From Schedule C C-EZ or K-1 Step 3. Web SEP IRA Simplified Employee Pension Plans SEP IRAs help self-employed individuals and small-business owners get access to a tax-deferred benefit when saving for retirement. UltraTax CS automatically calculates the maximum.

But for a cash balance plan your contribution will often be as high as 100 of W2. Contributions to a SIMPLE IRA. For example you might decide to contribute 10 of each participants.

Compensation for a self-employed individual sole proprietor partner or corporate owner is that persons earned. Web Use this calculator to determine your maximum contribution amount for a Self-Employed 401 k SIMPLE IRA and SEP. Web maximum contribution you can make to your plan.

When you purchase life and. Web You can contribute up to 25 percent of your adjusted net earnings from self-employment to a SEP IRA or the yearly dollar limit whichever is less. Web SEP IRA Contribution Limit Calculator Contribution Year Profit from Business whole dollars no commas or dollar signs Other Earnings eg.

Part III Calculate Your Maximum Profit Sharing Contribution 7. Web A SEP will allow you to get a contribution of 25 of your W2. Web Retirement plan contributions are often calculated based on participant compensation.

Web How much can I contribute to my SEP IRA. For comparison purposes Roth IRA and. From a day job whole dollars no commas.

Web The SEP IRA calculator will use this information to calculate how much youll be required to contribute to your employee accounts based on your own contribution rate. Web Multiply your net self-employment income by 25 to determine your maximum allowed SEP IRA contribution limit or 57000 for 2020 and 58000 for 2021 whichever. Web The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

Web Self-employed persons must use their net adjusted self-employment income as their compensation when theyre calculating their SEP-IRA contribution limit of 25. Your Contribution Amount is.

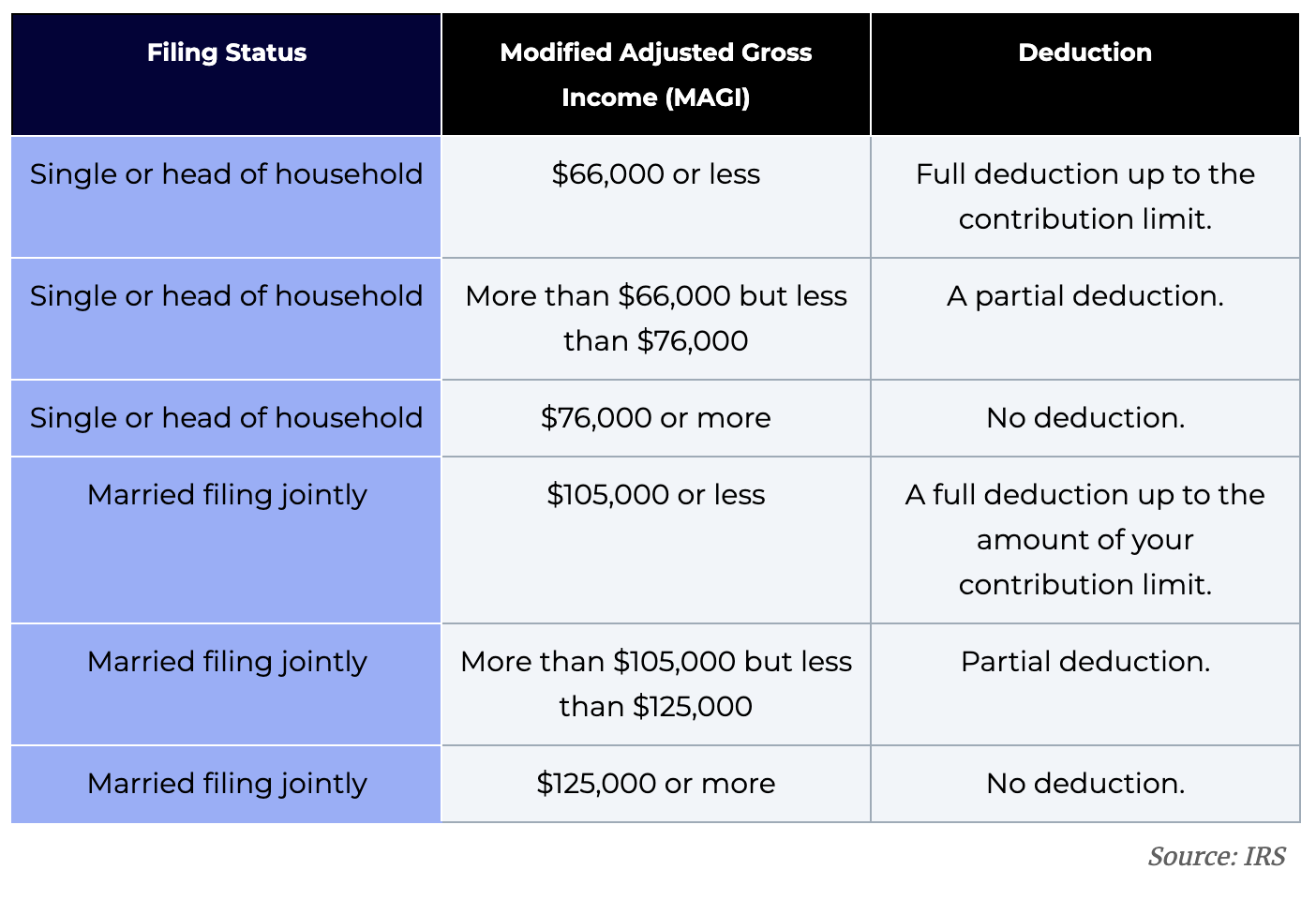

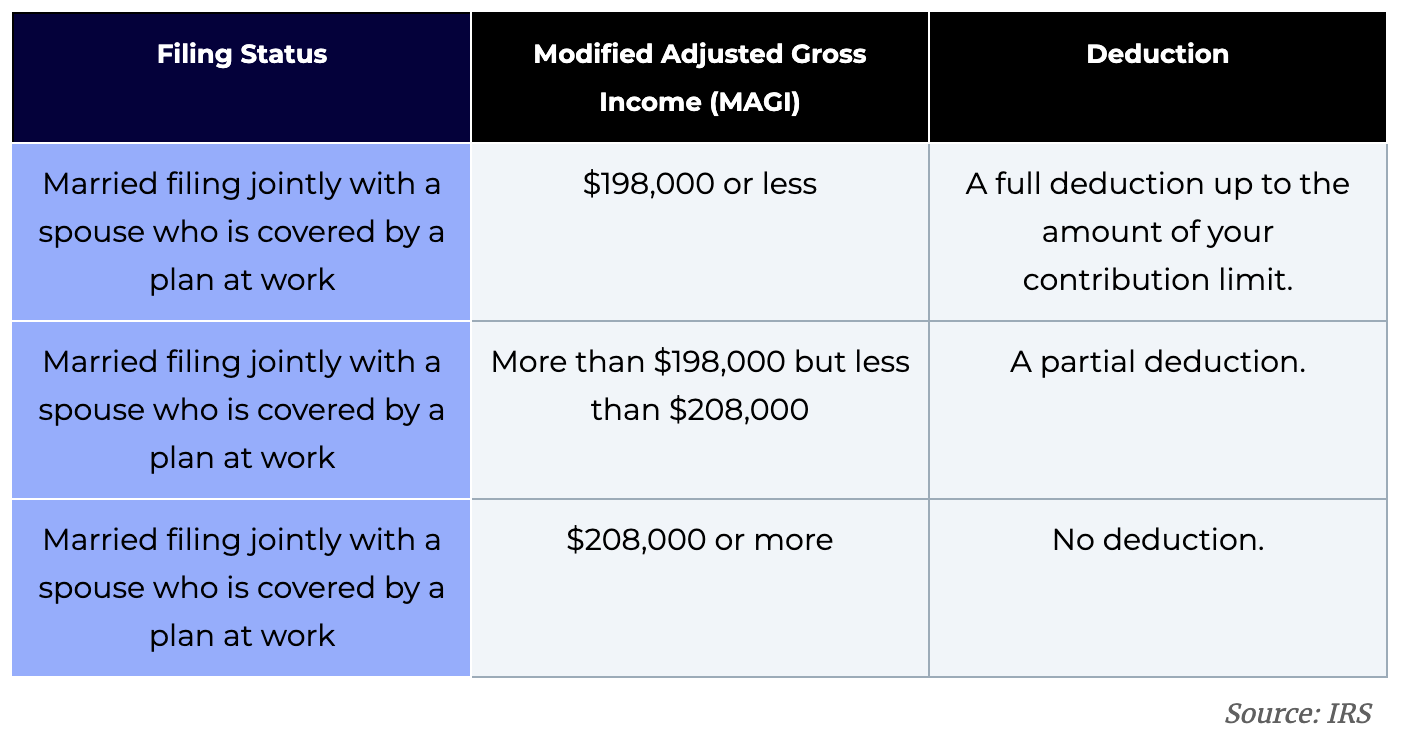

Ira Contribution Limits In 2022 Simple Sep And Traditional

7 Common Traditional Ira Rules Inside Your Ira Traditional Ira Ira Investing For Retirement

What Are Roth Ira Accounts Nerdwallet Roth Ira Individual Retirement Account Ira Investment

Vz8htueldwyjhm

Thinking Of Investing This Is Why You Need A Financial Advisor Financial Advisors Investing Financial

Think You Make Too Much To Use A Roth Ira Let Me Walk You Through The Backdoor This Step By Step Guide Will Walk You Thro Roth Ira Ira Financial Independence

The Ira Contribution Deadline For 2021 Is Almost Here Money

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth Ira What S The Difference

Advantages Of A Self Directed Ira Infographic Investing Infographic Infographic Financial Savvy

How To Calculate Sep Ira Contributions For An S Corporation Youtube

The Ira Contribution Deadline For 2021 Is Almost Here Money

7 Common Traditional Ira Rules Inside Your Ira Traditional Ira Ira Investing For Retirement

Sep Ira Plan Br Maximum Contribution Calculator

/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth Ira What S The Difference

The Ira Contribution Deadline For 2021 Is Almost Here Money

Advantages Of A Self Directed Ira Infographic Investing Infographic Infographic Financial Savvy